IMO 2020: Are We Ready?

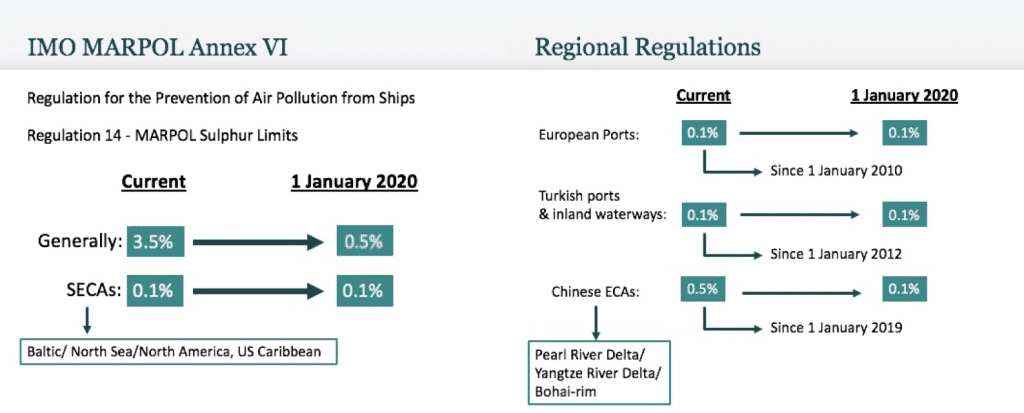

We are less than six months away from possibly the biggest regulatory change the shipping industry has seen since the phasing out of single-hull tankers. From 1 January 2020, ships will have to use fuel oil with a sulphur content of no more than 0.50% m/m under regulation 14.1.3 of Annex VI of the MARPOL convention (the “Regulation”).

This is a very significant reduction from the current 3.50% m/m. The Regulation will take effect immediately, leaving the shipping industry with two options:

- Using compliant fuel; or

- Adopting methods (such as the installation of scrubbers) that will efficiently clean the ship’s exhaust gas emissions before they are released into the atmosphere.

There is no doubt that the choice between these two options presents a number of commercial and legal conundrums for Owners, Charterers and Traders alike.

Using Compliant Fuel

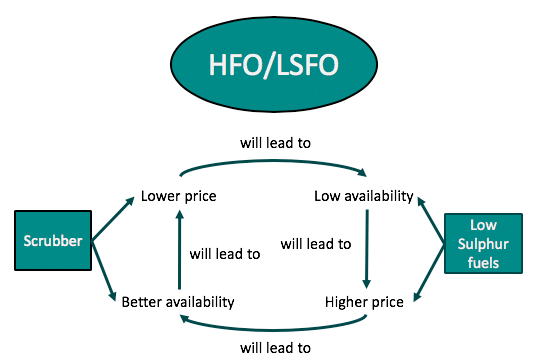

Marine Gas Oil (“MGO”) is at present approximately USD200/mt more expensive than HFO. Also, the likely increase in demand for complaint fuel creates an uncertainty around there being sufficient availability of compliant fuel.

The introduction of new blends of low sulphur fuel oil (“LSFO”) may alleviate availability concerns, however, it seems that in the short term, the costs of sourcing compliant fuel would likely be higher. In the medium to long term, however, it is not inconceivable that more players will enter into the market producing compliant fuel and thereby driving the price of compliant fuel down.

Using a Scrubber System

Some Owners have opted for using scrubbers as a means of complying with the Regulation.

One obvious incentive for installing scrubbers is the low price of using HFO (which could give Owners a competitive advantage when chartering out their vessels or a justification for increasing freight rate).

Nevertheless, applying the same logic as above, if there is an industry wide decrease in demand for HFO, there is a risk of reduction in the supply of HFO. In such circumstances, there is a possibility that the costs of sourcing HFO will increase. This could mean that the competitive advantage of having scrubbers installed could be lost rapidly.

There are also some environmental concerns over the open loop scrubber systems (that is a system whereby the wash water used to reduce sulphur in the exhaust gas is discharged back into the sea). This is evident from an increasing number of shipping regions including Belgium, California, Germany’s Rhine River, Singapore and China’s ECAs prohibiting the use of open-loop scrubbers. Owners will, therefore, have no choice but to burn compliant fuel while operating in these regions regardless of having incurred significant expenditure in installing scrubber systems onboard.

Key Legal Consideration

From a contractual point of view, Owners and Charterers should conduct an early assessment of the terms of their relevant contracts, including, charterparties, insurance policies and fuel supply contracts to minimise the scope for dispute.

With that in mind, we have produced the following table highlighting the key risks that Owners and Charterers alike should keep in mind when negotiating the terms of existing and future contracts of carriage:

Click here for the more comprehensive table.

Some of the key issues are briefly discussed below.

Availability of Compliant Fuel

As discussed above, one of the key concerns of the shipping industry is whether the compliant fuel will be readily available. Insufficient availability could lead to a heightened risk for ships that trade in remote areas.

Owners and Charterers should consider how best to minimise any disruption to the intended voyage given to the need to bunker more regularly or to travel to a further bunkering location to obtain compliant fuel. This is particularly important in a voyage charter for Owners as the consequences of a deviation not authorised by the contract can be drastic – i.e. Charterers can terminate the charter. Therefore, Owners should consider negotiating an expressed clause allowing them to deviate for the purpose of obtaining compliant fuel or for any repairs/maintenance required to the scrubber system.

Off-spec/Contamination claims

Various refineries are currently using different refining and blending techniques to produce new blends of LSFOs to meet the market demands. These new stocks of fuel are currently unknown to the market and it is not inconceivable that this may increase disputes around fuel stability and compatibility.

Given the possible introduction of a vast range of blended LSFOs, there is also a heightened risk of incidents arising out of bad bunkers. Early identification of characteristics of the fuels from suppliers may assist in minimising the scope for dispute. In addition, Owners and Charterers should specifically consider:

- Expressly agreeing permissible grade and specification (including the new sulphur contents) of compliant fuel to be used;

- Need for any associated indemnity provisions in the event that the fuel is found to be non-compliant;

- Reviewing sampling and bunkering procedures to be Regulation compliant;

- Agreeing specific fuel testing of any new blend of LSFOs; and

- Where possible, to renegotiate time-bar provisions in charterparties and fuel supply contracts.

BIMCO and INTERTAKO have produced sets of clauses to assist the market in addressing the general obligations of Owners and Charterers to comply with the Regulation. While they are very helpful, considering the heightened risk of operating on new blends of LSFOs, more comprehensive clauses should be sought to pre-empt the key risks including, responsibilities and costs associated with correct sampling, tank cleaning and the need for additional fuel tank installation.

Redelivery and Discharging non-compliant fuel

For ships that have opted the use of compliant fuel as opposed to scrubbers and where the ship is to be redelivered just before or after the D-date, there is a risk for Owners that there would be insufficient compliant fuel onboard the ship to reach bunkering port where complaint fuel will be available. Also, there are concerns over ensuring that by the carriage ban deadline of 1 March 2020 Charterers have discharged non-compliant fuel from the ship.

BIMCO have produced a very helpful transitional fuel clause which addresses the requirement to provide sufficient fuel that would allow Owners to reach the nearest bunkering port where compliant fuel will be available. It also addresses the obligation of both parties to cooperate to ensure discharge of the non-compliant fuel before the redelivery or carriage ban date, whichever occurs first.

In addition to the above, Owners and Charterers need to carefully consider whether practically there will be sufficient tank capacities onboard the ship to carry compliant and non-compliant fuel during any transitional period.

Scrubbers

Where the relevant ship is retrofitted with scrubbers to comply with the Regulation, Owners and Charterers will need to review their charterparty terms in order to ensure that the terms adequately allocate the responsibilities and costs of installation (including dry docking and off-hire clauses) of the scrubbers, maintenance and repair of the scrubber system, contingency plans to meet the regulation in the event of a breakdown of the scrubber.

Also, Owners should ensure that the vessel’s crew are properly trained to deal with operation and maintenance of scrubber system. Failure to provide such training could expose Owners to unseaworthiness claim down the line.

BIMCO have announced that they are working on a standard scrubber clause and this is due to be released around March/April 2019.

Fines

The non-compliant vessels will be subject to financial penalties by the Port States that have ratified the Regulation. The financial penalties will vary between the Port States. Such fines may not be covered under the parties’ insurance policies.

Both Owners and Charterers will wish to have any fines paid promptly in order to ensure that their vessel is not subject to detention or arrest. The contract terms should be reviewed to ensure clear allocation of these risks.

Latest Development

The fact that some oil majors, including Shell, Exxon Mobil and Total have rushed to patent their LSFO products raises concerns over whether this would deter smaller bunker players from entering the market in fear of expensive patent law suits. The impact on the shipping industry remains to be seen, but this could lead to the possibility of high costs for compliant fuel.

At the meeting of IMO’s sub-committee on Pollution Prevention and Response held in London between 18 to 22 February 2019, Regulators agreed to allow Owners a “safety loophole” – i.e. Owners may continue to burn non-compliant fuel, where Owners are unable to source compliant fuel without unnecessarily deviating from their intended route, or where Owners have reasonable concerns over the quality of the compliant fuel. In such circumstances, Owners are required to submit, via their flag states, a Fuel Oil Non Availability Report (“FONAR”) stating reasons for their inability to use compliant fuel. This has been generally welcomed by the industry, as it allows some breathing room, however, it must be remembered that the onus would remain with Owners to convince the relevant Port State Control authorities that they had valid reasons for failing to comply with the Regulation.

How might we help?

At Tatham Macinnes, we can assist Owners, Charterers and fuel suppliers with drafting and negotiating clear and well-structed contracts and, where the worst does happen, we can help effectively resolve disputes arising out of the regulation or quality issues.

If you have any questions in relation to this article or for anything else, please contact:

Sora Jeon – Partner

Tel: +44 (0)20 7929 1533_

Mobile: +44 (0)78 8129 6387

Email: sora.jeon@tatham-macinnes.com

Alex Macinnes – Partner

Tel: +44 (0)20 7469 2552

Mobile: +44 (0)79 5646 3588

Email: alex.macinnes@tatham-macinnes.com