Bunker Roundup |Part I: Off-specification VLSFO: Blame it on the COVID-19?

Amid the COVID-19 chaos, the oil industry witnessed a historical event when the price of US oil collapsed into negative territory for the first time ever[1]. In the first half of 2020, global and regional lockdowns and restrictions in response to the pandemic dried up the demand for oil to almost vanishing point.

Steep oil price drop

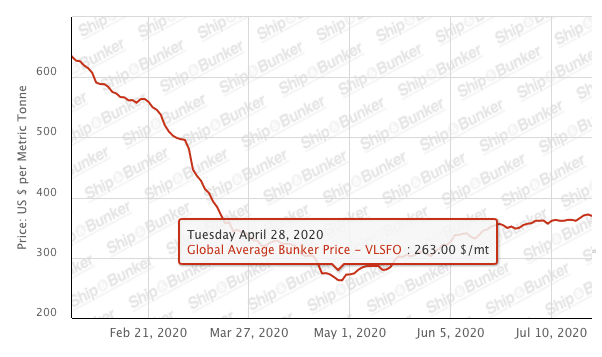

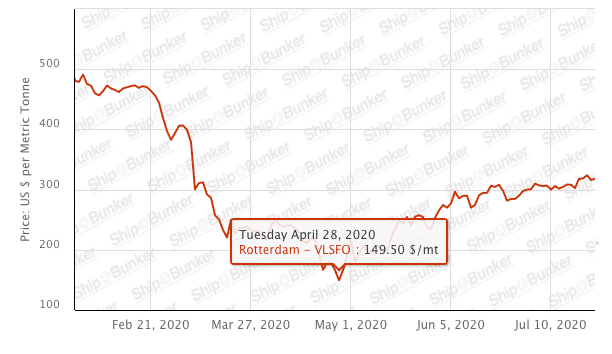

With the outbreak of the COVID-19 virus, statistics showed that the global average price for very low sulphur fuel oil (“VLSFO”) plummeted to $263.00 per mt on 28 April 2020. In particular, the price for VLSFO in and around Rotterdam hit a low of $149.50 per mt on 28 April 2020.

(Reproduced with kind permission of ShipandBunker)

(Reproduced with kind permission of ShipandBunker)

In response to the extremely bearish crude market, the shipping industry has reacted to shifting economics.

Many vessels from north Europe en route to Asia preferred to sail long detours around the Cape of Good Hope than to pay the Suez Canal Fees. A typical Suez Canal fee for a laden 20,000 TEU vessel can be approximately $700,000, which is roughly equivalent to the cost of 4,800 tonnes of high sulphur fuel oil (“HSFO”). With the benefit of the low oil prices, the five extra days of steaming would require less than 1,000 tonnes of additional fuel. Similarly, ships have been routing around the northern tip of Denmark as opposed to cutting through the German Kiel Canal, resulting in the latter suspending its crossing fees.

Extended oil storage

Whilst shipowners were enjoying historically low bunker prices during the pandemic, oil-storage facilities, both on shore and at sea, filled up quickly worldwide. It is reported that, at the world’s second largest bunkering hub of Fujairah, the inventory of heavy distillates and residues (a large portion of which were marine fuels) reached a record high of 16.5m barrels on 18 May 2020.

Following the implementation of the 2020 global sulphur limit, VLSFO has dominated as the marine fuel of choice. However, a demand decline due to COVID-19 has resulted in large stocks being stored throughout April and May. It has been reported that the combined stocks of fuel oil in the Amsterdam-Rotterdam-Antwerp region has hit a record high of 1.745 million at the beginning of May and June[2]. It is also estimated that around 5 million mt of fuel oil stocks are sitting in VLCCs around Singapore on July 13 2020[3].

This large scale storage of fuel brings potential problems. Amongst other things, complications could potentially arise from the use of fuel that has been in storage for an extended period of time. In this respect, the bunker quality testing house Veritas Petroleum Services (“VPS”) expressed their concerns that:

“Although longer-term storage of marine fuels is possible, it increases the risk of fuel quality issues arising from temperature, stratification, fuel stability, catfine settling, waxing and microbial growth. Heavy Fuel Oil (HFO), Very Low Sulphur Fuel Oil (VLSFO), Ultra Low Sulphur Fuel Oil (ULSFO) and Marine Gas Oil (MGO), all have different properties and formulations, which can be negatively affected due to longer-term storage.”[4]

As a rule of thumb, it is reported that shipowners can generally safely utilise marine gas oil (“MGO”) or heavy sulphur fuel oil (“HSFO”) stored for 12 months[5]. However, it has also been reported that VLSFO, in particular, tends to have “a lower tolerance to longer term storage and internal stability…[is] limited to [a] few months”[6]. This might be attributed to the fact that VLSFO is commonly produced by blending multiple product streams, which renders it chemically more complex. In other words, the fear is that VLSFO has a shorter expiry date.

Off-specification VLSFO

Even before the industry felt the impact of COVID-19, the stability and compatibility issues with VLSFO have already raised some eyebrows. We have learnt that VPS issued seven bunker alerts in relation to sediment issues within VLSFO between 24 December 2019 and 21 January 2020[7]. That said, the persisting COVID-19 situation has undoubtedly exacerbated the situation.

It has been reported that 8.8% of the samples of VLSFO tested by VPS in Europe during May 2020 has been found to be off-specification[8]. The Amsterdam-Rotterdam-Antwerp region has been identified to be the area with more off-specification fuel cases[9]. Issues arising from the large use of “expired” VLSFO i.e. surplus VLSFO that has been in storage for a long time, is thought, in particular, to include sediment issues[10]. Further, the situation is potentially worsened when using VLSFO that has been stored at sea for a long time.

The situation has potentially been exacerbated as a result of demand for road fuel weakening. Refineries have reportedly formulated new blending components and feedstocks (which were usually used to increase gasoline and distillates output) in order to produce 2020 compliant fuels. This new trend of blending inevitably introduces more volatile materials into the blended end-product. As a result, the viscosity and flash point of VLSFO has also been reported to have decreased[11].

On 19 August 2020, BIMCO, The International Chamber of Shipping (ICS), INTERCARGO and INTERTANKO published the “2020 Fuel Oil Quality and Safety Survey”[12]. This was produced in order to reveal the industry’s feedback towards the transition to IMO 2020 compliant fuel oils (0.5% sulphur). Amongst other things, the survey identifies sulphur, total sediment, aluminium plus silicon, pour point, ash, flash point, acid number and viscosity as the eight most problematic properties of IMO 2020 compliant fuel oils in accordance with ISO 8217 standards.

Implications

Owners and charterers need to be alert to the above issues. Often under typical time charterparties, the charterers will be under an obligation to provide suitable fuel. Proving the actual cause of off-specification or otherwise unsuitable fuel can be a challenge. Owners and charterers should check that the testing regimes take into account these issues. Different considerations apply, depending on which party’s perspective is considered, and the wording of such clauses can be crucial when disputes arise. A number of entities that both own and charter vessels will employ different clauses depending on which role they take.

Standard industry wordings do not address these issues sufficiently and, given the increased potential for disputes, these clauses should be considered and checked.

[1] A historic drop occurred on 20 April 2020 as the price of West Texas Intermediate (WIT) crude dropped by 300%, trading at around negative $37 per barrel.

[2] “Fuel oil sulfur spreads remain narrow following loss of bunker demand”, https://www.bunkerworld.com/news/insight/157659/Sarah-Jane-Flaws-Britt-Russell-Webster-Rowan-Staden-Coats-James-Goldburn-Tom-Washington/Fuel-oil-sulfur-spreads-remain-narrow-following-loss-of-bunker-demand

[3] “FEATURE: Bunker fuel quality issues vex market amid floating storage builds”, https://www.spglobal.com/platts/en/market-insights/latest-news/oil/072720-feature-bunker-fuel-quality-issues-vex-market-amid-floating-storage-builds

[4]“VPS Offers Marine Fuel Storage Monitoring”, https://www.v-p-s.com/latest-news/vps-offers-marine-fuel-storage-monitoring/

[5] “Shipowners and bunker players face headache amid build-up of low-sulphur fuel”, https://www.tradewindsnews.com/tankers/shipowners-and-bunker-players-face-headache-amid-build-up-of-low-sulphur-fuel/2-1-813648

[6] Ibid, Naeem Javaid, global operations manager of Lloyd’s Register Fuel Oil Bunkering Analysis and Advisory Service, told TradeWinds.

[7] “Bunker fuel quality issues surge as VLSFO use gathers pace: sources”, https://www.spglobal.com/platts/en/market-insights/latest-news/oil/020320-bunker-fuel-quality-issues-surge-as-vlsfo-use-gathers-pace-sources

[8] “Bunker fuel quality worsens due to IMO 2020 and coronavirus pandemic”, https://www.tradewindsnews.com/ship-management/bunker-fuel-quality-worsens-due-to-imo-2020-and-coronavirus-pandemic/2-1-827265

[9] Ibid

[10] High total sediment potential indicates the possibility that the long-chain asphaltenes held with residual component of a fuel may precipitate from the fuel solution forming a sludge. “Bunker fuel quality issues surge as VLSFO use gathers pace: sources”, https://www.spglobal.com/platts/en/market-insights/latest-news/oil/020320-bunker-fuel-quality-issues-surge-as-vlsfo-use-gathers-pace-sources

[11] Steve Bee, commercial and business development director of VPS told TradeWinds; see “Bunker fuel quality worsens due to IMO 2020 and coronavirus pandemic”, https://www.tradewindsnews.com/ship-management/bunker-fuel-quality-worsens-due-to-imo-2020-and-coronavirus-pandemic/2-1-827265

[12] “Industry Survey Shows Switch To Low-Sulphur Fuel Has Not Been Without Problems”, https://www.bimco.org/news/priority-news/20200819-industry-survey